Are you wondering, ‘What is staking?’ Get answers to all your questions about crypto staking and more right here in Bitbuy’s guide to staking crypto in Canada.

Because it is a relatively recent innovation in the cryptocurrency ecosystem, we are often asked what is staking in crypto or what does staking crypto mean.

Staking in the crypto world has emerged as an alternative to the traditional proof-of-work mechanism used by several cryptocurrencies to secure their networks. Simply put, staking means locking up your coins to support the functioning of a blockchain network and earning rewards in the form of additional coins.

By staking, cryptocurrency holders can participate in validating transactions on the network without investing in expensive mining hardware or burning through a significant amount of electricity. When a user stakes their coins, they contribute to the decentralization of the blockchain network and become a crucial player in the network’s security.

The process of staking involves setting up a staking node and connecting it to the blockchain network. The node validates transactions and broadcasts blocks on behalf of the network, and users who stake their coins provide the node with a percentage of the total amount they’ve staked. The rewards generated from staking come in the form of additional coins that the user can either hold or sell on exchanges.

In addition to being a way to earn passive income, staking has several benefits for cryptocurrency networks. For instance, staking makes it harder for attackers to take over a network as they would have to own a significant proportion of the staked coins. Moreover, staking aligns the interests of coin holders with that of the network, thereby fostering long-term growth and stability.

Some blockchain protocols allow participants to earn additional cryptocurrency by participating in the network’s staking process. The most popular cryptocurrencies to use proof-of-stake are Ethereum and Solana.

If you want to learn more about Proof of Stake and get answers to important questions like:

Proof of Stake chains create and validate new blocks through the process of staking. Staking involves validators who lock up their coins, so the protocol can randomly select them at specific intervals to create a block. Usually, participants that stake larger amounts have a higher chance of being chosen as the next block validator.

Most networks pay the staking reward in their particular staking currency, but some networks use a two-token system where the rewards are paid out in a second token.

On a very practical level, staking just means keeping funds in a suitable wallet. This enables essentially anyone to perform various network functions in return for staking rewards.

Proof of stake (PoS) is a consensus mechanism in blockchain technology used to verify and validate transactions on a network. Unlike proof of work, which uses computing power to solve complex mathematical problems, proof of stake uses staked assets to ensure the security and integrity of the network.

In a proof of stake system, validators must own a certain amount of the cryptocurrency in question to participate in the consensus process. The more cryptocurrency a validator holds, the more likely they are to be chosen to validate transactions. This creates an incentive for validators to hold onto their cryptocurrency, as it increases their chances of earning rewards for validating transactions.

Once a validator is chosen to validate a transaction, they must put a portion of their cryptocurrency at risk as collateral. This collateral ensures that validators have a stake in the network’s security and are incentivized to behave honestly. If a validator attempts to act maliciously, their collateral can be forfeited.

One of the main benefits of proof of stake is its energy efficiency. Unlike proof of work, which requires significant amounts of electricity to power computing equipment, proof of stake can be conducted on low-power devices. This makes it more accessible and eco-friendlier than proof of work.

Overall, proof of stake offers a more efficient and secure way of verifying transactions on a blockchain network. Its incentivized system ensures the network’s security while reducing energy consumption and promoting sustainability in the cryptocurrency industry.

Proof of Work (PoW) and Proof of Stake (PoS) are two distinct consensus mechanisms blockchain networks use to validate transactions. PoW involves a complex mathematical algorithm, which miners must solve to add blocks to the chain. Miners expend significant computational power to secure the network and receive cryptocurrency rewards.

Conversely, PoS relies on validators, who hold a certain amount of cryptocurrency, to confirm transactions and create new blocks. Validators are chosen randomly, with the chances of selection increasing as their holdings increase. While both mechanisms serve the same purpose of validating transactions, PoS is often touted as more environmentally friendly and efficient.

Mining and staking are two common ways of acquiring cryptocurrencies like Bitcoin and Ethereum. Mining requires complex computer systems to solve cryptographic puzzles and verify transactions on the blockchain. The first miner receives newly minted coins as a reward for solving the puzzle. Staking, on the other hand, involves holding a certain amount of cryptocurrency and using it to validate transactions. In exchange, stakers earn rewards in the form of additional coins. Both mining and staking require significant investments in hardware or cryptocurrency holdings. However, staking has a lower barrier to entry and is available to almost anyone holding stakeable crypto.

Staking pools are one of the hottest trends in the world of cryptocurrency, offering investors an innovative and profitable way to maximize their returns while minimizing their risks. In essence, staking pools allow users to combine their individual crypto holdings and collectively pool them together, which increases the chances of securing block rewards from blockchain networks. This is because pooling funds provides a larger staking capacity, increasing the odds of winning the rewards. It also reduces the cost of entry since it allows smaller investors to earn rewards on a smaller amount.

Staking pools also offer several benefits to their participants, such as greater security, reduced transaction fees, and improved returns on investment. However, as with any new technology, staking pools come with their own risks, including exposure to scams and lack of transparency.

Overall, staking pools are revolutionizing the world of cryptocurrency by democratizing the staking process and providing an efficient means for users to grow their digital asset portfolio with minimal hassle and maximum return. As more and more people become familiar with the concept, the demand for staking pools is only set to rise in the future.

If you want even more information about staking pools, check out our guide ‘What is a Staking Pool?’ that is full of helpful info. You’ll learn the answers to:

And more!

Not every cryptocurrency can be staked. To have staking, a cryptocurrency needs to use the proof-of-stake consensus mechanism. In 2023, only a small number of the many coins out there use POS.

When choosing the best staking coins in 2023, there are a few things to take into consideration. You’ll want to consider the amount of staking rewards available in terms of annual percentage yield (APY). Your decision should also factor in the coin’s upside potential in terms of market value.

When deciding on the best coin to stake, there are both rational and intuitive elements to consider. Experiment with different protocols and rewards but be sure to select a project that has staying power. By staking, you’re actively supporting the success of that project.

The advent of Proof of Stake (PoS) consensus mechanism has led to the emergence of staking, which allows crypto holders to earn rewards for securing the network. While Bitcoin, the largest cryptocurrency, does not currently support staking, several others do. There are many cryptocurrencies that can be staked, providing investors with an opportunity to earn rewards while supporting the underlying blockchain network. However, as with any investment, investors need to do their due diligence and thoroughly research each cryptocurrency before staking.

The staking process is different for each cryptocurrency, and investors need to research the requirements for each one. In general, staking requires holding a certain amount of the cryptocurrency in a digital wallet, with some wallets allowing for more flexibility and rewards than others.

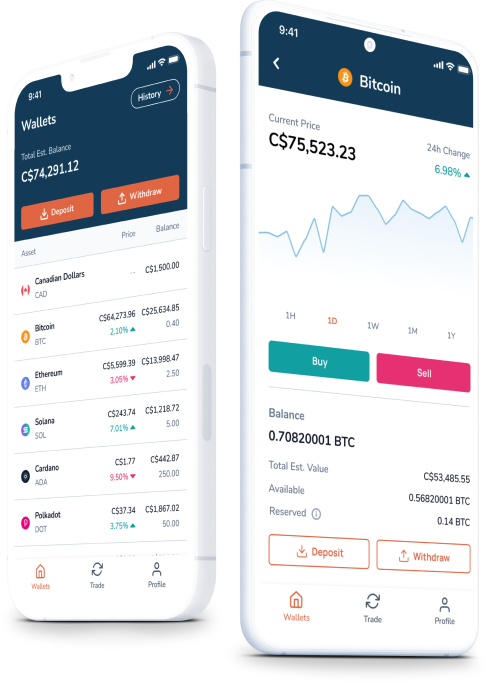

There are a growing number of cryptocurrencies that can be staked. Here are some of the most popular cryptos you can stake in Canada.

Staking Ethereum, or ETF Staking, has become increasingly popular among investors and enthusiasts who are excited about the potential of blockchain technology and want to contribute to its growth and sustainability. As more and more projects and applications are built on top of Ethereum, staking will continue to play a critical role in maintaining the network’s security and vitality. Here’s a helpful guide to teach you how to stake Ethereum in Canada.

While Ethereum was not the first cryptocurrency available for staking, it was surely one of the most highly anticipated. For crypto enthusiasts who want to learn about the Ethereum merge and the Ethereum Shanghai upgrade in early 2023, you’ll discover that the introduction of ETH staking really helped this part of the crypto ecosystem take off.

Polkadot, one of the most prominent blockchain projects in the industry today, has captured the attention of cryptocurrency enthusiasts, investors, and developers alike. Developed by the co-founder of Ethereum, Dr. Gavin Wood, the Polkadot blockchain is designed to offer a more scalable and interoperable alternative to other popular blockchains.

Polkadot’s primary focus is to bring different blockchains together, providing an ecosystem that promotes communication, collaboration, and seamless interoperability between chains. It accomplishes this through a unique design that consists of a multi-chain structure, allowing developers to create custom blockchain applications using different technologies while remaining connected to other chains within the ecosystem.

Polkadot is also focused on offering a more secure and efficient solution to the problems of scalability and interoperability, making it a potential game-changer in the blockchain industry. Additionally, the platform’s innovative parachain system offers more significant transaction throughput by providing a more streamlined and efficient method of handling smart contract execution and transaction processing.

Overall, the Polkadot blockchain shows immense promise, not only for developers looking to build next-gen blockchain applications but also for investors looking to participate in a potentially lucrative ecosystem. The platform’s continued success will undoubtedly continue to attract the attention of blockchain enthusiasts and investors alike in the coming years.

One of the biggest advantages of staking on the Polkadot network is its high level of interoperability. This means that different blockchain networks can connect and share information with each other, allowing for more efficient and streamlined transactions. Furthermore, Polkadot’s unique architecture allows for high scalability and faster transaction times, making it a top choice for stakers looking to earn rewards in a timely and efficient manner.

But staking on Polkadot isn’t just about earning rewards – it’s also about contributing to the overall health and stability of the network. By staking, individuals are essentially providing valuable resources crucial for the smooth operation of the blockchain. This level of community participation is essential for the continued growth and success of Polkadot, making staking an integral part of its overall ecosystem.

Solana is a highly scalable and high-performance blockchain that promises to revolutionize the industry by offering fast, low-cost transactions and seamless interoperability with other protocols. With its rapid adoption rate and ever-expanding ecosystem, Solana has quickly become a serious contender for blockchain dominance in the near future.

Solana’s popularity is increasing with each passing day. Its rapid rise in value is a testament to the trust and demand for the network. This is a blockchain that has potential, and it’s worth keeping an eye on as the technology continues to mature. In summary, Solana is a crypto to watch out for.

Staking Solana involves holding Solana’s native token SOL and contributing to the network’s security and consensus. Staking rewards are paid out in SOL tokens, and the amount you can earn is directly proportional to the amount you have staked.

One of the biggest benefits of staking Solana is the ability to earn rewards while also contributing to the network’s growth and development. Staking also helps to secure the network by ensuring that there are enough validators to keep the network running smoothly. Another benefit is the fact that staking rewards are earned passively. You do not need to actively trade or monitor the market to earn rewards, which makes staking Solana an ideal option for long-term holders.

Staking Solana is a highly profitable and innovative way of earning passive income in the world of cryptocurrency. With its fast-growing network and low transaction fees, Solana is an excellent choice for investors looking to stake their crypto assets.

Polygon is an exciting cryptocurrency that has taken the digital world by storm. Its mission is to make Ethereum a faster, cheaper, and more accessible platform for everyone. As a result, Polygon has gained a lot of traction among investors and traders alike, and its value continues to rise every day.

Polygon, previously known as Matic Network, uses a Layer 2 scaling solution to solve some of the critical problems Ethereum is currently facing, including high transaction fees and slow confirmation times. Its primary goal is to enable Ethereum to support mass adoption and, in the process, become a dominant force in the cryptocurrency industry.

Polygon Crypto has been a game-changer in the world of crypto. Its focus on low fees and fast transaction processing times makes it a desirable choice for users. This cryptocurrency has also received a lot of attention because of its growing community. This community consists of a vast number of developers and users, making Polygon one of the most active and rapidly growing blockchain projects out there.

One of the advantages of staking on Polygon is the lower transaction fees, as the platform offers much cheaper gas fees compared to the Ethereum network. This reduces the barriers to entry for users, enabling even smaller investors to participate in staking. Additionally, staking on Polygon requires a lower minimum stake than other staking platforms, providing users with more flexibility and convenience.

Cardano is a blockchain platform that is changing the face of digital transactions as we know it. Developed by Charles Hoskinson, the co-founder of Ethereum, Cardano is the first blockchain platform built on a scientific philosophy. It is a proof-of-stake (PoS) blockchain that uses the Ouroboros consensus protocol to validate transactions.

One of the most notable features of Cardano is its use of a layered architecture. The platform is divided into two layers - the settlement layer and the computational layer. The settlement layer handles all transactions and balances, while the computational layer deals with smart contracts. This architecture ensures scalability, security, and flexibility, making Cardano one of the most efficient blockchain platforms.

Cardano’s native currency, ADA, is fast becoming one of the most popular cryptocurrencies in the world. With its focus on security, scalability, and interoperability, ADA has proven to be a formidable digital asset in the market. Governments, corporations, and individuals are currently using ADA for various purposes, including cross-border payments, micropayments, and investment opportunities.

Staking Cardano is an excellent investment opportunity for those looking to earn passive income while contributing to the network’s security. With the promise of additional functionality in the near future, including smart contracts and other features, the potential rewards for staking Cardano are only set to increase over time.

Cryptocurrencies have become the go-to investment option for many people looking to make money in the digital age. One of the ways investors can earn profits from cryptocurrencies is through staking. Staking is a process where cryptocurrency investors lock up a certain amount of their digital assets for a fixed period and, in exchange, earn rewards.

However, not all cryptocurrencies can be staked. There are various reasons for this, but the primary reason is that not all cryptocurrencies are designed to support staking. Staking requires a cryptocurrency to have a Proof-of-Stake (PoS) consensus mechanism. The PoS mechanism allows validators to confirm transactions and secure the network by locking up their cryptocurrencies. In contrast, cryptocurrencies that use a Proof-of-Work (PoW) mechanism require validators to perform complex mathematical computations, and they receive rewards in return.

Moreover, the amount of cryptocurrency required to stake can vary depending on the coin. The required stake for some cryptocurrencies can be incredibly high, making them inaccessible to smaller investors. As such, cryptocurrencies designed for large institutions or those looking to hold cryptocurrency long-term may not support staking.

The main reason why not all cryptocurrencies can be staked is that not all of them are designed for the process. Staking requires a cryptocurrency to have a specific mechanism that is incompatible with others. Furthermore, the stake amount needed can vary, making staking inaccessible for many investors. While staking can be an effective way to earn passive income in cryptocurrency, it is not always possible for all cryptocurrencies.

Staking cryptocurrency has become a popular method for users to earn passive income. If you are interested in staking crypto, you should first research the different cryptocurrencies that offer staking. Various cryptocurrencies like Ethereum, Cardano, Polkadot, and many more offer staking. After deciding on a particular cryptocurrency, you should look for a reliable and trustworthy platform to stake your coins, like Bitbuy in Canada.

Staking rewards have become an increasingly popular trend in the cryptocurrency space. It is a way for holders of specific cryptocurrencies to earn passive income simply by holding their coins in a wallet or staking pool.

Staking Rewards refers to the incentives provided to users who lock up their cryptocurrency holdings in a specific network. The primary purpose of staking rewards is to encourage users to become more active in maintaining the blockchain’s integrity, promoting decentralization, and securing the network. Additionally, it provides users with a passive income stream while keeping their crypto holdings secure. By participating in staking, investors contribute to the long-term growth of the ecosystem, and at the same time, they are incentivized for their contribution.

Rewards can range from annual interest rates to additional cryptocurrency tokens depending on the crypto you stake. Staking also provides investors with a sense of stability and certainty, knowing that they are holding onto their crypto for a longer period. In addition, staking can act as a passive income stream, with little effort needed beyond holding onto your assets. Some projects even offer token holders voting rights, allowing them to have a say in network development and governance. So, whether you’re in it for the profits or to support the blockchain, staking crypto has its perks.

Like cryptocurrency staking, yield farming generates high returns on cryptocurrency holdings by participating in various decentralized finance protocols. By providing liquidity to these protocols, investors can earn rewards in the form of newly created tokens. While yield farming carries some risks, such as price volatility and potential contract exploits, many investors have found success by carefully choosing their investments and closely monitoring their positions. As decentralized finance continues to evolve, yield farming will likely remain an essential aspect of this growing ecosystem.

At first glance, the whole staking crypto thing may seem like it ought to be complicated. Fortunately, there are safe and secure, government-regulated cryptocurrency platforms in Canada like Bitbuy, where staking crypto is quick and easy.

The way staking rewards are calculated may differ between each blockchain network. Some are adjusted on a block-by-block basis, taking into account many factors. These can include:

For some other networks, staking rewards are determined as a fixed percentage. These rewards are distributed to validators as a sort of compensation for inflation.

Crypto staking has become an increasingly popular way to earn passive income within the crypto space. By holding and locking up a certain amount of cryptocurrency, users can participate in network validation and receive rewards in return. But is crypto staking profitable?

The answer to this question is not black and white, as it ultimately depends on the individual’s specific circumstances and investment goals. Factors such as the type of cryptocurrency being staked, the staking rewards offered by the network, and market conditions can all affect the profitability of crypto staking.

However, many investors have found crypto staking to be a profitable endeavour. With the potential for staking rewards to deliver high returns, it can provide a higher return on investment than traditional savings accounts. Additionally, by contributing to network validation, staking also helps to support and strengthen the crypto ecosystem as a whole.

Start earning rewards up to 11.57% in a regulated environment. Earn passive income by allowing the network to use your holdings to forge new blocks on the blockchain. It’s a win-win. You earn rewards, and the coins you invest in benefit from increased stability.

Get started

When you stake crypto, you support the blockchain of your favourite cryptocurrency. Not only will you be part of writing a new block and sustaining the viability of the blockchain, but you will also get rewarded for it. Here's how the process works:

We provide Canadians with convenient, dependable, and secure access to staking and buying and selling cryptocurrencies. Established in 2016, we've gained a reputation as Canada’s most trusted and secure cryptocurrency exchange platform.

Bitbuy is the first TSX-listed company and one of the only OSC registered crypto trading platforms in Canada to be given regulatory approval to offer staking.

When you stake with Bitbuy, your assets are not loaned out to earn rewards. Your assets are always held at a 1:1 ratio, you can see our latest Proof-of-Reserves audit here.

With Bitbuy staking, you don’t have to worry about extended lockup. We make it easy for you to unstake and withdraw anytime subject to each network’s unbonding period.

Buying cryptocurrency directly from individuals is slow and risky. We make the process faster and far more efficient.

You can use your bank account directly to fund your Bitbuy account, which you then use to buy and sell cryptocurrencies in Canada.

Participate in creating new blocks in the blockchain while you earn rewards. Unlike mining, crypto staking does not require expensive equipment or loads of resources. All it takes is holding the crypto you already invest in.

Staking is a way to earn rewards on your crypto by participating in the block creation and validation process for a Proof-of-Stake network.

Simply put, you are locking up the crypto you already hold, putting it into a staking pool, and the pool will use those coins to help validate transactions. Staking helps crypto networks confirm all of the transaction data in a blockchain.

By holding your crypto assets, you are participating in a network's consensus-taking process. Like a miner in a proof-of-work network, stakers are helping to approve and verify transactions on the blockchain. For doing that work, you get rewarded. A helpful analogy is to think of the rewards as you think of interest in your bank account or dividends on your investments.

Staking is another way to invest in crypto. It's an alternative to mining or purchasing crypto.

You earn rewards from staking crypto for validating transactions and producing blocks on the blockchain. Earned rewards generally come from a combination of transaction fees and new token emissions.

For putting your holdings into a pool, you get paid rewards. The rewards are paid out frequently, and you will clearly see your staked assets in your account and the rewards you earn at all times—just like all of your holdings with Bitbuy.

A key to staking crypto is understanding the differences between proof-of-work and proof-of-stake. Their goal is the same: to protect the network's decentralization, but they get to that goal differently.

If you have heard of mining crypto, you are familiar with proof-of-work validation.Validating transactions occurs as people compete to solve a highly complex equation. The process takes a lot of computing power. The person that produces the solution gets to write the new block of transactions in the blockchain and is rewarded with coins. The more computer power a miner has, the greater the odds of winning. It is a resource-intensive process that is expensive, slow, and uses massive amounts of energy. Despite these limitations, it has functioned asa trusted consensus mechanism that is reliable and secure.

An alternative to proof-of-work is proof-of-stake. People stake their crypto coins in a proof-of-stake validation network instead of using computing power. You provide your coins to a network computer (or a node), and they participate in a contest to forge the next block. Through a variety of factors, the network selects a winner. Whoever wins gets to forge the next block into the ledger and is rewarded with coins.

Proof-of-stake is not a competition between supercomputers. Staking creates a contest between ordinary stakeholders. If you win, you can forge the blockchain's next block and are rewarded with coins. Additionally, you get the satisfaction of participating in your coin's blockchain and helping combat its volatility.Proof-of-stake is a more cost-effective and balanced way to validate transactions, and it creates an incentive to keep coins, making them less volatile.

Yes! Your rewards are automatically compounded as your they are restaked. See more information here.

Simply put -a HODLER of crypto is typically the best candidate to stake crypto. If you are already planning on holding a crypto coin for a long time, why not earn some rewards for putting your crypto to work? HODLERS love staking because it tends to be significantly less risky than other ways people make rewards in crypto, such as higher-risk borrowing and lending. Some consider staking to be on the lower end of the risk curve for earning rewards for HODLERS. If you are holding already, why not make some rewards while you wait?

Staking involves validators who lock up their coins, so they can be randomly selected by the protocol at specific intervals to create a block. The process can be boiled down to these three steps:

Solana (SOL), Ethereum (ETH), Polkadot (DOT), Polygon (MATIC), Cardano (ADA), NEAR Protocol (NEAR), Cosmos (ATOM), Injective (INJ) and Celestia (TIA) are currently available to stake on Bitbuy.

There are 100+ staking products available, but we are selective about what we make available to our users, given our regulatory status. We will announce full details of new coins to stake in the future.

Your staking rewards are automatically added to your Bitbuy account. The payout time will vary depending on the coin.

For example, if you are staking 100 SOL, and the estimated annual reward yield is 5.6%, over the course of a year, you would expect to have 105.6 SOL (the 100 SOL you initially staked, and the 5.6 SOL you earned in staking rewards).

Your crypto rewards are generated by your participation in a staking node. Your rewards will NOT be generated from lending out your crypto assets.

Your staking rewards are automatically accrued and paid out as long as your crypto remains staked, based on the blockchain network's variable staking rewards rate.

The staking rewards rate changes depending on many factors related to the coin, but generally so as long as the administrator of the node (our Institutional partners) do a great job, the crypto rewards from staking will be paid to you.

Your staked crypto assets will be stored in institutional-grade cold storage provided by BitGo, a market leader in compliant digital asset custody solutions.

For Ethereum staking, it will be locked in a deposit smart contract which remains in the control of BitGo on behalf of Bitbuy.

It is as easy as using the rest of the Bitbuy platform. If you hold a coin, with just a few clicks your coins will be staked. It will be just as easy to stop staking when you want your funds unlocked and made available for trading in your account again.

You can start adding funds to your Bitbuy account today. After you have created an account, you will then need to take a couple of more steps:

1. Deposit funds with the fiat currency of your choosing and deposit cash to invest, even as little as $20.

2. Choose your cryptocurrency order (market or limit order).

That’s it!

There are three main advantages of staking crypto. First, it is a less energy-intensive process. Because staking does not require proof-of-work, there is no need for supercomputers and the energy consumption they require.

Secondly, it is easier to earn rewards from crypto staking. You are not competing against supercomputers to solve complex problems. Instead, you can leverage your crypto in exchange for earning rewards. Simple.

Finally, there is no special equipment required. All you need is some crypto and a Bitbuy account. Getting started is as easy as 1,2,3.